Definition

Related Definitions

Cost-Push Inflation

What is cost-push inflation?

Inflation is the rise in general price levels in the economy. When inflation is caused by any supply-side factors like a rise in the cost of production, it is called cost-push inflation. This is because when the cost of production increases on the side of producers, the aggregate supply in the economy decreases, and the burden falls on the consumers too in the form of price rise in the economy.

Summary

- When inflation is caused by supply-side factors like a rise in the cost of production, it is called cost-push inflation.

- When the cost of production increases, producers reduce the number of people employed and raise the prices of their products to retain their profit margins. As a result, the economy's aggregate supply shrinks- this leads to an increase in price levels and a decrease in output levels in the economy.

- An increase in wages and increased raw material cost are the main reasons for cost-push inflation in the economies.

Frequently Asked Questions (FAQs)

What is aggregate supply?

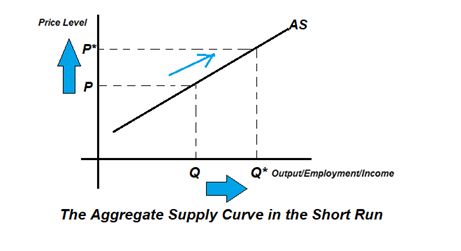

The relationship between the general price level in the economy and its production level is known as aggregate supply. Because the amount supplied increases as the price rises, the short-run aggregate supply curve is upward sloping as shown below.

Copyright © 2021 Kalkine Media

When the price levels increase in an economy by level PP*, there is an extension in the output in the economy by level QQ*, explaining the positive relationship between the two variables.

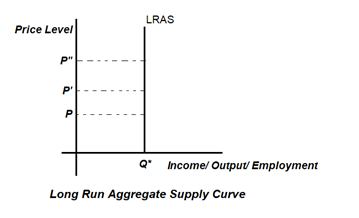

The aggregate supply curve is completely vertical in the long term- this is because of the view that in the long run, the economy is at full employment level output (Q*in the diagram given below.) So, regardless of the price level in the economy, the output and employment level in the economy will stay put at that level. As a result, the long-run aggregate supply curve is perfectly inelastic at full employment level of output and is parallel to the axis representing the economy's price levels.

Copyright © 2021 Kalkine Media

What is the impact of cost-push inflation on the economy?

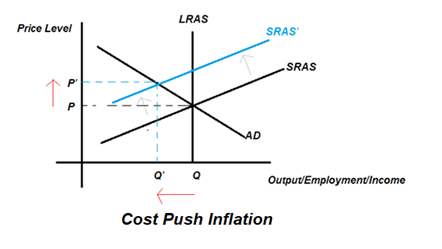

The concept of cost push inflation can be explained with the diagram given below. Initially, the economy is at equilibrium at the AD and SRAS curve intersection at output level Q and price level P. In the diagram, when wages increase or there is a rise in the cost of raw materials, the cost of production increases. To maintain their profit levels, the producers cut down the number of workers employed and raise the prices of their products. As a result, the aggregate supply in the economy decreases. As a result, the aggregate supply curve shifts leftward, as shown in the movement from SRAS to SRAS'- this results in a rise in price levels from the initial level of P to now P’ and also a decline in output and employment levels in the economy as shown in the movement from Q to Q’. The upward movement in price levels in the economy by PP' is called cost-push inflation.

Copyright © 2021 Kalkine Media

What causes cost-push inflation?

Cost push inflation is triggered in the economy due to factors that increase the suppliers' cost of production and thus impact their profit margin. The cost of production rises as workers seek higher wages. Wage push inflation was common in past times when there was a greater reliance on human labour since technological growth had not yet reached the heights it has now. As a result, labour unions wielded enormous power. The unions' call for a strike had the potential to impede production. Thus, management took their demand seriously. In earlier times, wage push inflation in the economy surged due to labour union pressure when management boosted salaries for workers. Government policy to raise minimum pay for workers is another probable driver of wage push inflation.

Cost-push inflation can also be induced by an unexpected increase in the price of imported goods. For example, when a home currency depreciates, the cost of importing the same amount of commodities increases.

Similarly, adverse weather, a lack of or excess rainfall, insufficient fertiliser supplies, or subsidy reductions push costs up in agricultural markets. All of these factors affect industries that use farm goods as raw materials.

Oil price shocks also cause Cost-push inflation. When oil prices in the economy rise, all oil-importing countries experience inflation. In 1973, when Arab members of OPEC (Organization of Petroleum Exporting Countries) decided to raise oil price by nearly four times, inflation and recession erupted.

Higher taxes and fewer subsidies can also drive up manufacturing costs, resulting in cost-push inflation.

What can be done to control cost-push inflation?

The government might use a deflationary policy like increased income tax or reduced spending to control inflation. The central bank might also consider raising interest rates- this would raise borrowing costs while reducing consumer spending and investment. However, while employing any measure, the government must be sure that the output and employment levels in the economy do not experience a severe decline. Better supply-side measures that help to enhance productivity and shift the AS curve to the right could be the long-term solution to cost-push inflation. These policies, however, would take a long time to take effect.

Why is it essential to control inflation in an economy?

Inflation wreaks havoc on economies by influencing investment and business decisions. Rising inflation widens the difference between nominal and real interest rates. Inflation, on the other hand, also decreases people's financial savings. Further, in expectation of future price hikes, producers and suppliers may not release stock commodities. Finally, the most severe risk associated with inflation is that it may spiral out of control, wreaking havoc on the economy due to hyperinflation. Therefore, when the economy's inflation rate starts to rise, it's critical to keep it under control.