Definition

Related Definitions

Bond Trading

What is Bond trading?

Bond trading refers to the process of exchange of bonds between the investors. It is a way of diversifying trading portfolio including cash and stock. It is a way of investing and making profit from the fluctuation in the value.

A bond is debt financing, it is financial investment securities where an investor gives money to an institution or government for a specific time period, and in return will get interest as a payment until bond reach its maturity period.

Summary

- Bond trading refers to the process of exchange of bonds between the investors.

- The central banks perform the monetary policy in the bond markets.

- There is an inverse relationship between interest rate and prices of bonds.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Understand Bond trading

Bond trading means exchange of bond to make profit in terms of interest. Bond trading plays a vital role in global economic market, bond trading happens so many times in an hour. The central banks perform the monetary policy in the bond markets; bond market is bigger in comparison of stock market.

Bond trading includes bond investor and bond dealer. Bond trading is done by a trading platform or bond dealers. These dealers have a huge network of computer and telephone links. All the interested players are connected through with links of computer and telephone. They also make market for bonds and have information about different group of bonds and quotation of bonds.

Bond investors includes an individual, financial institution who invests in bonds. Bond investor is also known as bondholder. These bond dealers along with bond investors form an institutional market where large group of bonds are traded.

Frequently Asked questions (FAQs)

How does bond trading work?

Bonds defines as financial instruments that issued by the company or government to the investor. Investor lends money to the company and will get defined interest as fixed payment till the maturity of bond and after the maturity will give the original sum back. A bond’s return is fixed but still the stock markets may cause the price to go up and down. Before investing an investor should know the most important thing is to understand how bond trading works. Finding out which bond is going to increase in value is the toughest task for an investor. There are two major things which make a bond’s value increase are:

- Declining interest rates: There is inverse relationship between interest rate or price of bond, when the interest rate rise, the prices of bonds already has been issued will down and vice versa. Declining interest rates affects all bonds, though change in degrees depends on factors like the bond’s maturity. This is the reason old bonds tend to give more than the new ones, so old bonds give more returns.

- The issuing company is less risky: If a company is in good business or has a wealthy goodwill that would raise the bond’s price. Lower risk directly indicates a rise in bond’s price. In other words, anything that makes a business less risky or vice versa, it would affect the bond’s price. Therefore, bond traders take their decision based on these factors to find bonds that will give good returns and resulting in capital gains with rise in price.

What do you mean by bond quote?

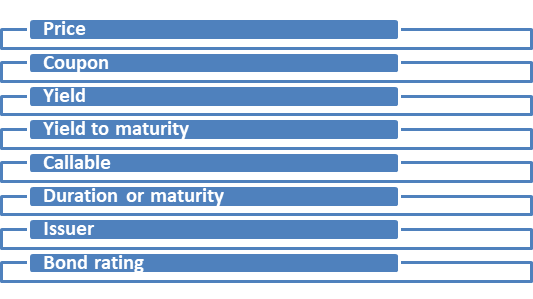

Whenever an investor decides to buy or sell a bond, broker will give a lot of information about the bond. To understand about the trade, it is important to know the terms.

- Price: This signifies the amount at which the bond was purchased. It is the last traded price of the bond showed as a percentage of the bond’s par value.

- Coupon: It is the price of bond, which an investor has to pay, expressed in relevant currency.

- Yield: It refers to the amount which calculated by is dividing the coupon with the bond’s price.

- Yield to maturity: It refers to the amount (yield) assuming an investor hold the bond to maturity.

- Callable: This means the company can recall the bond or it can force it to be redeemed.

- Duration or maturity: This shows that when the bond matures.

- Issuer: Whosoever issues the bond is known as the issuer such as a company, government.

- Bond rating: Bond rating is how ratings agencies have valued/rated the bond.

Source: Copyright © 2021 Kalkine Media Pty Ltd

What are the different bond trading strategies?

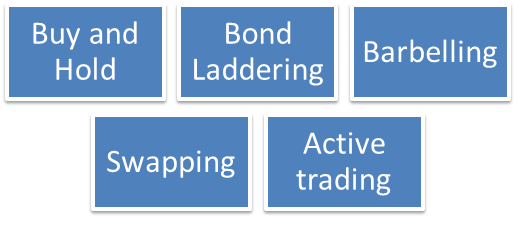

Bond trading cover various strategies.

- Buy and hold: This helps in terms of generating income. A person buys a bond and holds it to maturity. It is helpful in minimising costs and increasing the income generated from bonds. It is better not to sell bonds when interest rate is high because it will cause decline in value of bonds.

- Bond laddering: Bond laddering strategy focuses on minimising the cost and providing good income with smooth swings in interest rates. According to this strategy, an investor holds bond with different maturities. For example, an investor holds several bonds maturing in two, three, or six years. When a shorter period bond matures, the investor escalates to a longer term bond with the old bond’s proceeds through laddering.

- Barbelling: As per this strategy, the investor focuses on buying long- and short-term bonds and a few of medium-term bonds because of this the portfolio looks like a barbell. This strategy offers the advantage of higher yields. This strategy works when the rates in the market are stable.

- Swapping: It helps in improving the overall portfolio of an investor. In this strategy, an investor sells a bond that is not likely to recover soon and buy or reinvest in other bonds that will give them better return. An investor takes this opportunity and invest his money in a more profitable bond.

- Active trading: In active trading, an investor uses one or more strategies for bond trading to get high capital gains. Investors focuses on analysing the business and economic factors to find out which bonds are going to increase in value. This strategy needs more advanced skills.

Source: Copyright © 2021 Kalkine Media Pty Ltd