Definition

Related Definitions

Base Rate

What is Base rate?

The base rate refers to the rate set by the central bank of a country, below which the commercial banks and other financial institutes are not allowed to lend money to their customers. Base rate affects all the interest rates set by other financial institutes or banks for providing loans to their customers.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Understanding of Base rate

Base rate is decided by the central bank of a country. Every country has different base rates, which are set by their central banks. Commercial and other financial institutes cannot give loans at an interest rate lower than the base rate.

The central bank decides bank rate to enhance transparency in the credit market and make sure that banks provide fund to their customers in lower cost. Loan pricing depends on base rate and a suitable distribution of loans depends on the credit risk premium.

Many people confused base rate with bank rate. Bank rate refers to the rate charged by the central bank of a country from commercial banks for the borrowings. If the central bank reduce or increase the bank rate, commercial banks and other financial institutes have to change its interest rate accordingly.

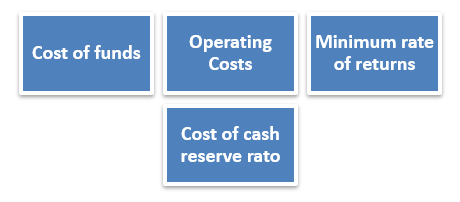

Calculation of Base Rate

The calculation of base rate has been done by the country’s central bank. Whether it’s nationalised banks or the private sector, the central bank decides the base rate in order to make uniform rates to all banks within the country. Base rate is calculated by taking various things into focus. It includes:

- the administrative costs of the bank,

- cost of deposits,

- previous year P/L of the bank and

- Unallocated overhead costs.

The central bank also keeps other factors into consideration at the time of calculating the base rate. Cost of deposits plays vital role to calculate the new benchmark. Banks may decide its base rate as long as they follow the rules of central bank that below which the commercial banks are not permitted to lend.

What are the determinants of base rate?

Following factors determine the base rate:

Source: Copyright © 2021 Kalkine Media Pty Ltd

- Cost of funds: Cost of funds refers to the cost banks and other financial institutions pay in order to acquire funds. For example, interest rate on deposits.

- Operating costs: Operating costs is the cost which incurred from day-to-day operational activities such as electricity bill, rent etc.

- The minimum rate of returns: Minimum rate of return is the minimum profit investors expect to get from an investment.

- Cost of the Cash Reserve Ratio: Cost of cash reserve ratio refers to the cost which a commercial bank has to bear in order to maintain cash reserve ratio according to the rules of central bank.

What is the relation between monetary policy and base rate?

Monetary policy/Credit policy refers to the policy which is used by the government of a country to maintain stable economy by regulating financial system through central bank. Aggregate demand is affected by monetary policy of a country; the Central bank is responsible for interest rates and controls the money supply in an economy.

Base rate is a tool of monetary policy which is used to control the money supply and demand in economy. Increase in money supply or money flow in market indicates rise in demand, rise in demand leads the inflation in economy. To control inflation central bank increases the base rate that the money supplies in the economy.

Banks mainly lends money to companies and households in the economy. Central bank ensures the availability of credit from financial institutions and banks to companies and households.

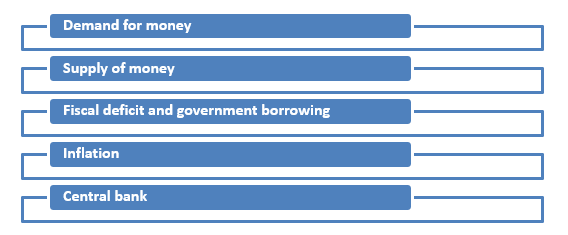

What are the factors affecting base rate?

There are various factors that affect base rates in an economy are as follow:

Source: Copyright © 2021 Kalkine Media Pty Ltd

Demand for money: In today’s world money is in demand. Most of companies need money in order to invest and borrow money from banks and different financial institutes. Manufacturing sector companies and industries borrow money from banks for short term and long term investment. People borrow money for buying homes, cars, luxury items and other things. Entrepreneurs need money to start new business but when an economy isn’t doing that well, they all are avoid borrowings. The higher demand for money in an economy, which means higher interest rates.

Supply of money: When money flows in economy more than the demand it indicates excessive money supply in market. If the flow of money is more than the demand of money in an economy, then base rate may go down. When the market is not good, investor reduces the production according to their product demand. In this situation investor doesn’t have much demand and leads rise in money flow in an economy.

Fiscal deficit and government borrowing: When government expenditure exceeding government revenue is called fiscal deficit. The government borrows money for funding its fiscal deficit. Government is the largest borrower in the economy of a country; the government borrowing influences the base rate by affecting the demand for money.

Inflation: Inflation refers to rise in prices of all goods or commodities and services of basic use such as clothing, transport, food etc. Central bank changes the base rate to control inflation. Purchasing power of an individual has to control by higher interest rates. In inflation investors will have to invest in fixed income investments if they want to get positive real rate of return. In order to have saving even in inflation an investor should keep the real rate of return positive, the interest rates stay up and vice versa.

Central bank: Central bank of a country will focus on several objectives at the time of the preparation of its monetary policy. In a boom economy, the central bank focuses on inflation and accordingly hikes interest rates. Central bank set base rate for commercial banks below which the commercial banks and other financial institute are not permitted to give to their customers.