Definition

Related Definitions

Balanced Fund

What is a balanced fund?

A balanced fund is a mutual fund that includes bonds and stocks, and a mutual fund is a collection of shares that investors can buy.

A balanced fund is a hybrid fund defined as an investment fund with diversification across two or more asset classes. It is also known as an asset allocation fund. The amount of money invested in each asset class by the fund must generally stay within a specific range.

Balanced fund portfolios, unlike life-cycle funds, do not vary their asset mix or adjust their holdings to reduce risk as an investor's retirement date approaches. On the other hand, actively managed funds may change in reaction to the investor's shifting risk-return appetite or overall investment market conditions.

Summary

- Balanced funds invest in various asset types, including a combination of low- and medium-risk equities and bonds.

- Balanced funds invest in generating income as well as capital growth.

- Balanced funds can provide capital appreciation and income to investors with a low-risk tolerance, such as retirees.

Frequently Asked Questions (FAQs)

What is the investment objective of a balanced mutual fund?

Balanced funds usually adhere to a fixed asset mix of stocks and bonds, such as 70% stocks and 30% bonds, which are debt securities that typically offer a predictable, fixed rate of return.

A balanced mutual fund's investment objective is typically a mix of income and growth, resulting in the fund's balanced existence. Balanced mutual funds are ideal for investors seeking a combination of income, stability, and moderate capital appreciation.

Source: © Eamesbot | Megapixl.com

What are the characteristics of a balanced fund?

- Balanced funds are described as investments in both debt and equity shares of a company at a balanced ratio, lowering an investor's risk and allowing the fund manager to change the fund's portfolio based on market conditions.

- When compared to pure equity funds, balanced funds offer reduced risks, but their returns are not guaranteed.

- Because of the reliance on market circumstances and the fund manager's abilities, dividends on balanced funds cannot be relied on for regular income.

- Balanced funds offer their investors a diversified portfolio by investing in several products such as equities and bonds.

- In the event of bearish markets, these funds automatically rebalance the investor's portfolio, allowing fund managers to sell equity funds to keep the fund at its most significant level and vice versa.

Source: © Viruswin32 | Megapixl.com

What are the various sorts of balanced funds?

Debt-oriented balanced funds invest a significant amount of their assets in a company's debt instruments. These funds entail a lower risk because they can deliver consistent returns over time.

Equity-oriented balanced funds invest many of their assets in equity and derivatives, allowing for rapid capital growth.

Source: Copyright © 2021 Kalkine Media

Who should consider investing in a balanced fund?

- Because the managers of balanced funds strive to achieve a balance between assets, they may switch from equities to debt investments, or vice versa, depending on their performance. As a result, these funds are best suited for investors with a relatively high-risk appetite.

- Investors in this fund must be looking forward to retiring early because there is shallow risk and no lock-in time, justifying the high liquidity option.

- These funds are appropriate for new investors who want to see a modest return on their capital before committing to more aggressive mutual fund investments.

- Investors who are prepared to take on some risk should choose balanced funds over debt funds because balanced funds require a lower level of risk while providing much better returns.

- Investors seeking long-term capital preservation should use a balanced fund that invests mainly in high-rated bonds and large-cap equities.

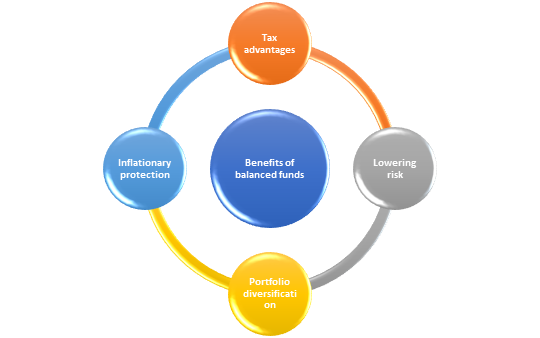

What are the benefits of investing in balanced funds?

Tax advantages

Fund managers can pick between equity and debt without exposing investors to a tax burden due to their investment strategy.

Lowering the risk

Investing primarily in equities funds is a high-risk strategy. In hybrid funds, however, debt instruments serve to balance out the risk that equity funds entail.

Investing portfolio diversification

When it comes to diversifying one's financial portfolio, these funds are the most excellent option. Because these funds provide a safety net against market-related risks while also assisting in maximising returns, they are a perfect way for investors to limit their investment responsibilities.

Inflationary protection

Because debt assets make up a percentage of hybrid funds, they can operate as an inflation hedge. If the investment contains international bonds, for example, they can shield investors from inflation by providing access to countries that are not affected by it.

Apart from that, these funds allow investors to withdraw money from the funds regularly without affecting the asset allocation. As a result, these are low-investment schemes that can maximise profits while safeguarding investors from various market dangers.

Source: Copyright © 2021 Kalkine Media