Definition

Related Definitions

Annual Report

What is an Annual report?

A document that provides an extensive overview of the company’s financial and operational conditions to its shareholders, customers, employees, government and investors on a yearly basis is known as an annual report.

Nowadays, annual reports are created by organisations as a marketing tool to attract the attention of donors, investors and shareholders and to highlight their brand in the open market.

After the 1929 stock market crash, standardised annual reporting was made mandatory by lawmakers. These reports are utilised by the investment firms and individual investors to make investing decisions.

What are the key components of an Annual Report?

Traditionally, annual reports had a significant amount of text to give an overview of the company’s previous year’s performance. However, today’s annual reports contain graphics, visually appealing content and images to gain the attention of new investors.

In today’s market, sustainability annual reports are also released to project the sustainable operations of the organisations.

The structure or chronology of annual reports differs from company to company, but as per the regulatory requirements, the majority of the annual reports contains the following sections:

- Information about the cooperation – The vision and mission statement are included in this section.

- Letter from the CEO – The letter generally highlights the information which will be of interest to shareholders. The section provides a brief summary of the company’s performance along with the achievements.

- Financial and operational highlights of the year – This section is dedicated to project the key achievement of the company in the past year such as awards, goals accomplished and special (corporate social responsibility) initiatives undertaken by the firm.

- Financial statements – It is the critical element of an annual report as decisions related to investment are based on the measurable data stated in the form of the balance sheet, income statement and cash flow statements. Furthermore, the financial statement may include the graphical presentation of the quantitative data and allowing comparison with the past year’s performance. The appendix and footnotes give the opportunity to further break down the data.

- Plan for future growth – A report also incorporates the future objectives and goals of a corporation to gain the trust of shareholders. It also allows shareholders to acknowledge the current status of the organisations in respect of the competing firms. Moreover, the strategy to accomplish the mentioned goal is also stated in the annual reports.

Copyright © 2021 Kalkine Media Pty Ltd

Who are the readers of Annual Reports?

The reports are made publicly available through the organisational websites of publishing in the local newspaper to cater to the need of stakeholders, that is, shareholders, customers, potential investors (investment firms, individual investors, partnership firms, organisations looking for partnership, mergers and acquisition or collaboration) and employees.

- Protentional investors – The annual reports give investors a better understanding of the current and future position of the organisation through the combination of qualitative and quantitative data. On the basis of personal and technological interpretations, investment decisions are made.

- Employees – In the majority of the firms, employees are the shareholders of the firm, so the annual report helps the employees to evaluate different investment options in the firm. Additionally, reports are utilised by employees to investigate the future focus of the firm.

- Customers – In the present circumstances, consumers are aware of the products and services they buy. According to a survey by Accenture, 40% of the participants stated that they would not pay for a brand that is socially and ethically irresponsible Therefore, customers go through annual reports to determine the quality of the company’s suppliers. Also, the report gives a fair idea about the current status as well as the future plans of the firm. This leads to generation of new investors.

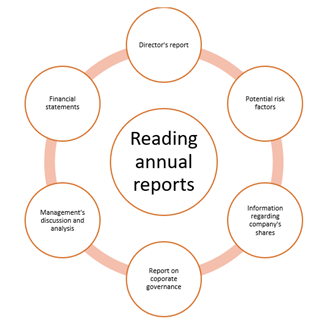

Why should investors read an annual report before taking investment decisions?

For investment decisions, investors should read the 10K fillings by the firms which either submitted separately to the security exchange commission or combined with the annual report. 10k filling report firstly provides detail about the company, then the risk factors, legal issues (if any), the financial data, director’s report and lastly the management’s discussion.

The director’s report should be the first component of analysis as it gives a quick view of the company’s performance, theme, goals, returns to name a few. The analysis of the director’s report determines the attractiveness of the industry.

Management’s discussion is one of the crucial components as it describes the views of the person who is at the top of the management and takes major decisions. The section focuses on the business strategy, emerging competition, game plan to name a few. When the management decision is compared with the quantitative data, the content validity of organizational data can be ensured.

Financial data incorporates both financial highlights and financial statements. It allows assessment of the company’s performance over the past few years. It projects whether the balance sheet has become strong or weak from last year. The cash flow statements describe the sustainability and health of the business. The disparity in the middle of the income statement and cash flow statement can raise an alarm. For example, if the cash flow is negative and the net income is reported, then it is a red flag.

Investors should look for the risk in the firm as it impacts the organization’s long-term performance and in a few cases the firm’s income. The legal proceedings section describes the litigation activities and the legal risks.

The corporate governance indicates the actions taken by the firm to align the interest of the shareholders with organisation goals. The section is crucial as positive relationship has been observed between corporate governance and value of the shares.

Information on company’s share discloses the average trading volume and average trading price. Furthermore, the shift in the ownership of the shares is also incorporated. Red flags are raised in case the stake of promoters reduces significantly.

Copyright © 2021 Kalkine Media Pty Ltd